Shift your focus from customer service to delight

In today’s digital world, the insurance industry is encountering a fast-changing landscape. There is a drastic transformation of engagements in satisfying customers. Gone are those days, the customer goes to an insurance company and asks for policy details etc. Now the Insurance company is reaching the customer at their doorstep for opening an account. Insurers focus more on customer service excellence due to its personalized services and products in a swift way.

So, to meet and satisfy customer expectations, insurance companies need to find more interactive ways to get positive customer responses for business acceleration. Hence the insurance industry needs a system that could drive and give a 360* holistic view of your entire customer lifecycle process, and effective lead generation tools in a cost-effective way.

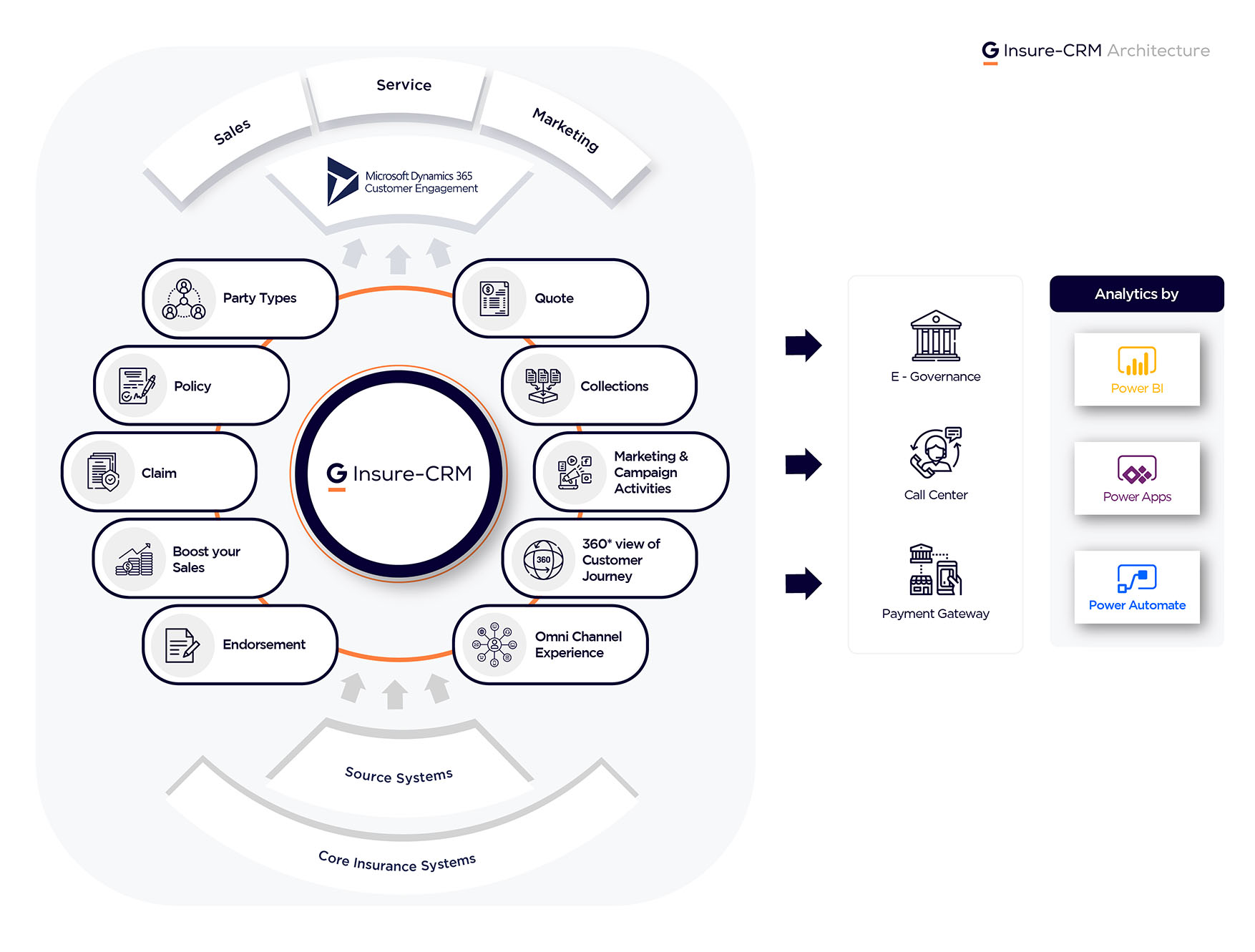

G Insure-CRM built on Microsoft Dynamics 365 Customer Engagement can be tightly INTEGRATED with any core insurance software and help the Insurance company to strengthen all customer engagement activities, sales, and marketing activities and under one unified platform. G Insure-CRM can empower the Insurance company with a comprehensive customer lifecycle process and the support they need to deliver and exceed customer expectations and to reach customer delight.

In today’s digital world, the insurance industry is encountering a fast-changing landscape. There is a drastic transformation of engagements in satisfying customers. Gone are those days, the customer goes to an insurance company and asks for policy details etc. Now the Insurance company is reaching the customer at their doorstep for opening an account. Insurers focus more on customer service excellence due to its personalized services and products in a swift way. So, to meet and satisfy customer expectations, insurance companies need to find more interactive ways to get positive customer responses for business acceleration. Hence the insurance industry needs a system that could drive and give a 360* holistic view of your entire customer lifecycle process, and effective lead generation tools in a cost-effective way.

G Insure-CRM built on Microsoft Power Apps can be tightly INTEGRATED with any core insurance software and help the Insurance company to strengthen all customer engagement activities, sales, and marketing activities and under one unified platform. G Insure-CRM can empower the Insurance company with a comprehensive customer lifecycle process and the support they need to deliver and exceed customer expectations and to reach customer delight.

G Insure-CRM at a glance

Key Features:

- 360* single view of the customer lifecycle

- Boost your Sales

- Centralized system for Policy Holder Information

- Claim Management

- Marketing and Campaign management

- Analytics Reports

- Call Center Integration

- Offer Omni Channel Experience

- E-Governance

- Payment Gateways

- Payment and Collections from all Channels

As an insurance company, we faced many daunting challenges like customer acquisition and retention. This is due to the disintegration of subsystems and lack of lead generation, tracking the effectiveness of marketing campaigns, and absence of social media marketing.

With the help of G Insure-CRM, we were able to penetrate the market deeper using social media marketing techniques, an innovative lead management system, and a comprehensive view of each customer right from registration to claim settlements. Also, it changed the entire lead tracking system to a more meaningful process, it identifies a potential lead and alerts us through email or call notifications. We are happy to work with Global iTS and its team.

Why G Insure-CRM?

360* View of the Customer Relationship

G Insure-CRM encompasses a 360* view of the customer journey in all the facets. We can see the past, present, and future of the customer information with the insurance industry. Such as current policies, premiums, opportunities, open claims, alerts, Insurance agent details, renewal notification, accounting balance, etc. It provides an entire customer summary just a click away.

Centralized Policy Holder Information

G Insure-CRM allows the inhouse-staff and agents role-based access to customer history, preferences, key relationships, profitability, and support records, helping them to increase client confidence and improve productivity across the organistaion.

Boost your Policy Renewal

G Insure-CRM facilitates the insurance company by sending a notification to remind its customers of their policy renewals in advance. It helps to plan specific marketing campaigns to upsell their solutions at the time of renewals. It provides an opportunity to segment their policyholders in terms of insured value or premium to be paid. Thus G Insure-CRM aid the insurance company to boost the sales performance and achieving overall customer satisfaction.

Payment and Collections from all Channels

G Insure-CRM is tightly integrated with a core insurance solution to give real-time data in terms of collections. The insurance company can collect the premiums through many channels like a branch, online, insurance agents, insurance aggregators, etc., At any given time core insurance systems should have the updated payment details of the customer.

Claims Management

Settling claims and timely approval of claims and disbursement are critical to the Insurance business. Customers believe that faster the claim process is a sign of a good insurance company. At the same time, Insurance company must make sure it should be a proper claim without any malicious motives. Hence the authenticity of the claims is considered the crucial aspect of the insurance business.

G Insure-CRM by integrating with core insurance products provides proper intimation about the claims and its nature. It gives a complete flow from making a claiming till disbursement.

Call Center Integration

G Insure-CRM integrates with call center applications like Interactive Voice Response (IVR) system, telephone system (PABX), and other call center solutions to enable customer service engagements smoothly and swiftly.

Third-Party Integration

G Insure-CRM can easily be integrated with Third Party Applications.

Boost your sales

The crux behind digital transformation is all about business growth. This can be achieved only through customer delight. To make customers happy is all about how well we engage with them, what do we offer, response time, options to choose, flexibility, and overall effective communication.

G Insure-CRM will integrate with the core-insurance system to derive various information to provide and support insurance companies to make their customer happy and ensure their goals are achieved. It helps you to be proactive than reactive. Many companies in the market are reactive to customers, which is not a good sign.

G Insure-CRM gives timely notification, the complete history of the customer, policy options, and overall it will help them to serve better

Omni Channel Experience

G Insure-CRM offers a seamless omnichannel experience to insurance companies and customers through a unified platform. It helps to bring together user interface and different channels of engagement with the customer for a consistent and powerful experience.

Robust Marketing and Campaign Activities

The modern school of thought proves digital marketing and social media marketing are quintessential to target customers and boost sales.

G Insure-CRM can integrate swiftly with any core insurance solution to target and segmentize based on demographics, income levels and many more and plan marketing campaigns accordingly. They can start with lead generation through cold calling, mass email campaigns, social media campaigns like Facebook, Twitter etc.

Payment Gateways

Today’s customers are active in the digital world. They want results just by the snap of a finger. Many insurance companies are offering their customers to make payments through mobile phones, online transfer, digital money like PayPal, using debit and credit cards.

G Insure-CRM has an inbuilt capability to integrate with Payment Gateways to enable them to make online payments safely and securely.

E-Governance

G Insure-CRM will integrate seamlessly with the traffic authority for extracting data on policy and validating the same. Also, the integration helps in knowing your customer (KYC) details and verifying it on the fly. This will be handy in a crisis where things get done faster and efficiently.

Analytics Report

G Insure-CRM can deliver real-time dashboards that provide insight into clients, brokers, risk exposure, sales activities, and sales performance by region, branch, and agents.

Want to know more about G Insure-CRM?

G Insure-CRM Architecture

What are the Benefits?