The Rise of Customer Evolution in New Age Banking

Banking Industry has seen tremendous changes in the past 20 years. A couple of decades ago the primary objective of banking was all about deposits and withdrawals, customers have to spend several hours to get this done. In the 21st century, every nuance of banking has changed drastically. Today saving accounts can be opened without even going to the branch. Customers get their cheque books to debit cards within a couple of hours of opening the account. Today’s primary objective is to engage customers, empower with choices, and retain customers. It has become a compelling factor for the banks to approach the customer personally and satisfy their needs. Yes, there is a paradigm shift happening in the Banking industry, they started to focus more on the customer-centric approach model. Banks are trying to find all the means to understand, reach, and satisfy the customers. Hence Banks needs a powerful customer engagement application that can drive greater profitability through customer acquisition, retention, and improved operational efficiency in a cost-effective way.

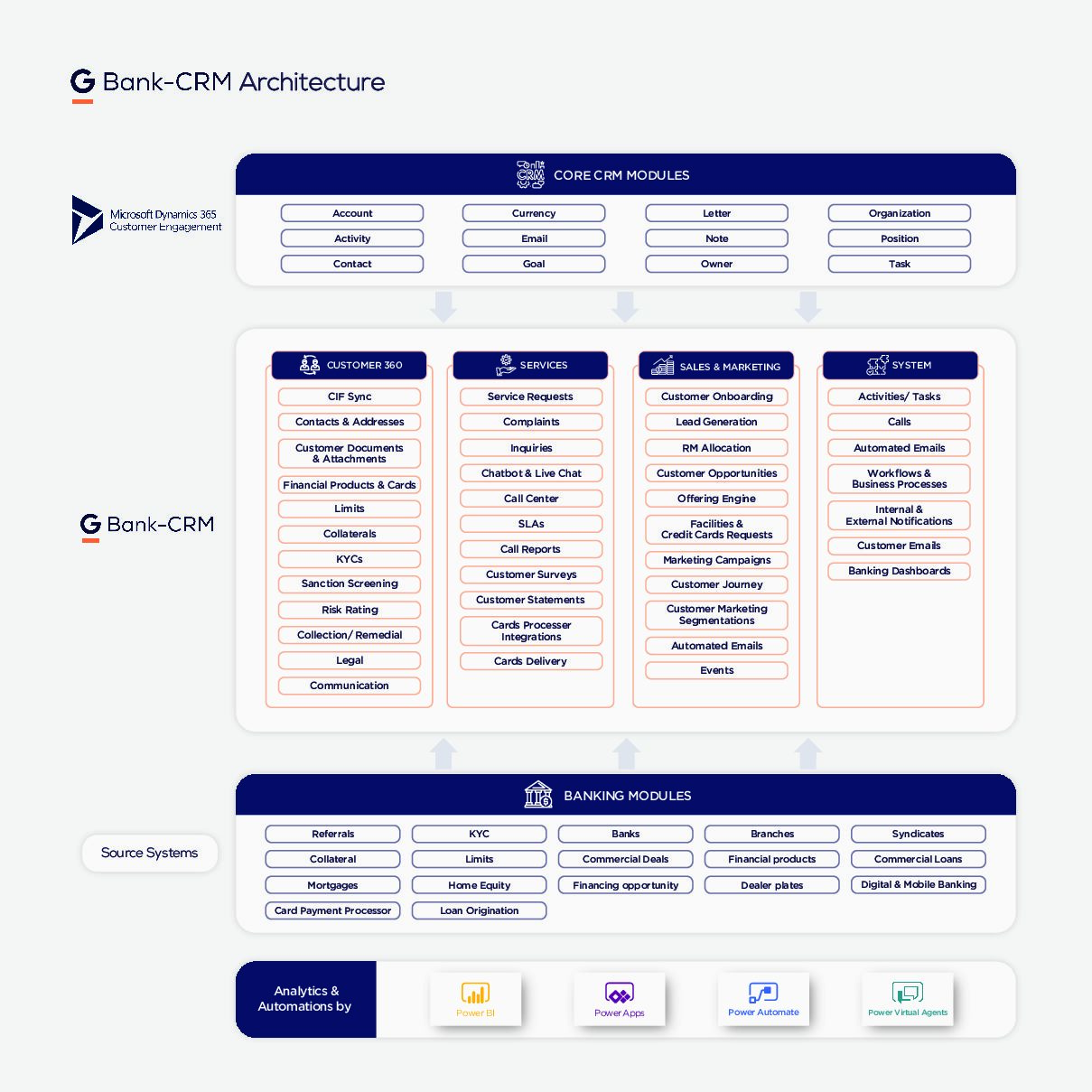

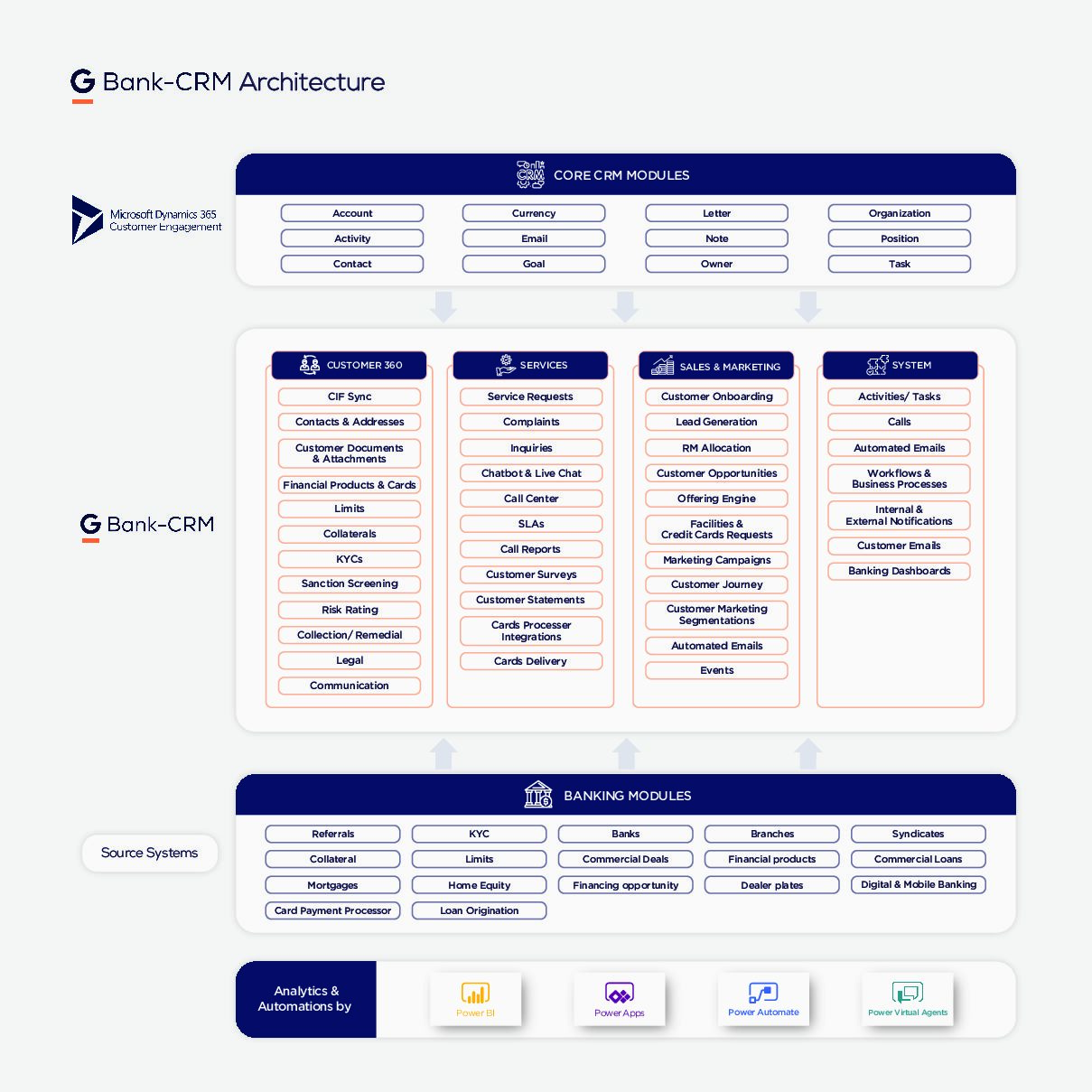

G Bank-CRM built on Microsoft Dynamics 365 Customer Engagement can be tightly INTEGRATED with any core banking application and help the Banking Industry to reach its heights, by giving a 360* view of customer lifecycle process and reinforce all customer engagement activities, sales, and marketing activities and service under one unified platform. G Bank-CRM is a powerful integrator tool where it addresses the unique needs of the Banking Industry.

Banking Industry has seen tremendous changes in the past 20 years. A couple of decades ago the primary objective of banking was all about deposits and withdrawals, customers have to spend several hours to get this done. In the 21st century, every nuance of banking has changed drastically. Today saving accounts can be opened without even going to the branch. Customers get their cheque books to debit cards within a couple of hours of opening the account. Today’s primary objective is to engage customers, empower with choices, and retain customers. It has become a compelling factor for the banks to approach the customer personally and satisfy their needs. Yes, there is a paradigm shift happening in the Banking industry, they started to focus more on the customer-centric approach model. Banks are trying to find all the means to understand, reach, and satisfy the customers. Hence Banks needs a powerful customer engagement application that can drive greater profitability through customer acquisition, retention, and improved operational efficiency in a cost-effective way.

G Bank-CRM built on Microsoft Power Apps can be tightly INTEGRATED with any core banking application and help the Banking Industry to reach its heights, by giving a 360* view of customer lifecycle process and reinforce all customer engagement activities, sales, and marketing activities and service under one unified platform. G Bank-CRM is a powerful integrator tool where it addresses the unique needs of the Banking Industry.

What do we offer?

- 360* single view of the customer lifecycle

- Territory Management

- Centralized system for Customer and Product Information

- Marketing and Campaign management

- Lead Management

- Sales Opportunities

- Offer Omni Channel Experience

- Contact Center Integration

- Compliance Management

- Other Microsoft Products Integration

- Analytics Reports

- Automation of Workflow

- Third Party Integration

For any Bank, the maintaining of customer data in a single repository is one of the biggest challenges. In our Bank also all our customer information was fragmented in multiple systems which resulted in inconsistent processes, duplication of work, and leakage of customer information.

After implementing G Bank-CRM, all our customer information is centralized under one platform, which helps our employees to view 360* of the customer journey, also it simplified us to choose the right customer for cross-sell service and upsell services. G Bank-CRM has made us travel impeccable journeys on the customer lifecycle.

We are delighted to ally with Global iTS in this journey.

Why G Bank-CRM?

360* View of the Customer Relationship

G Bank-CRM comprises a 360* view of the customer journey in all facets. It helps the Bankers to have a profound understanding of the customer information across multiple channels such as managers, advisors, branches, self-service websites, backend systems, and more. Can see the past, present, and future of the customer information with the Banking industry.

Centralized Customer and Product Information

G Bank-CRM integrates with core banking applications and provides a single repository source on products, services, and customer information for both internal and external parties.

Marketing and Campaign Management

G Bank-CRM helps in planning product campaigns and marketing strategies. It integrates closely with the core banking system and uses customer details to segment, targeting, and positioning various products as per customer background based on demographics, income levels, age, and gender basis. It will help the banks to plan key advertising campaigns, mass mailing campaigns, social media campaigns like Facebook, Twitter etc, specific products for niche customer groups like HNI, VIP, and corporate customers.

G Bank-CRM will provide the outcome/impact of the campaigns and marketing initiatives taken by the bank.

Lead Management

G Bank-CRM is closely integrated with the core banking application to generate leads. Potential customers can come in various ways. They might visit a branch, check your website, enquiry through a call center, or direct sales. Assigning the lead and converting into a prospect is a very critical aspect of Banking. It is also an equally important task to understand their requirements clearly and hence G Bank-CRM helps to manage the entire process from generating a lead to converting into a customer.

Boost your Sales

G Bank-CRM ensures a swift sales process and helps the customer service executives/call center reps to upsell and cross-sell based on customer information and position products/services as per the profile.

G Bank-CRM tightly integrates with the core banking system and gives complete visibility on lead management, opportunity management, sales pipeline, and relationship management.

Compliance Management

Banking Industry is responsible for a country’s growth or decline, hence they are highly regulated, scrutinized by the watchdog called Central Bank or Apex Bank of the country. They have been governed by the rules, regulations, policies, and procedures strictly laid down by the apex bank.

G Bank-CRM allows the Bankers to ensure that they are on top of regulatory and compliance requirements through automation while protecting privacy and confidentiality. For example, when there is a change in regulations, the CRM dashboard will pop an alert to the Banker stating that the client needs to complete the new form or note in terms and conditions. So there is transparent communication with the clients, which gives confidence to the customer that their relationship is on top of other things.

Omni Channel Experience

Omnichannel is all about offering identical services and experience across all platforms online and offline to the customer may it be in the branch, call center, mobile, or website. Customers can perform banking without any disruption or lag in their journey.

G Bank-CRM ensures this by integrating with the core banking system to offer this experience seamlessly.

Territory Management and Planning

G Bank-CRM integrates seamlessly with core banking applications to facilitate the Banks to run a smooth operation. Banks having many branches across different cities and regions, handling sales, and planning region-wise targets and performance metrics are always challenging tasks.

G Bank-CRM helps the bank to define the territory, appoint resource manager, manage task assignments, routing, and finally branch wise, region-wise sales targets are mapped and reviewed periodically.

Contact Center Integration

G Bank-CRM integrates with call center applications like Interactive Voice Response (IVR) system, telephone system (PABX), and other call center solutions to enable customer service engagements smoothly and swiftly.

Other Microsoft Products Integration

G Bank-CRM is built on Microsoft Power Apps can seamlessly be integrated with other Microsoft products. Bankers can easily adapt to other Microsoft products such as Outlook, Power BI, and Office 365 which are familiar in the market. Thus it enables to increase in productivity and better service.

Analytics Report

G Bank-CRM can deliver real-time dashboards that provide insight to Bankers, decision-makers on the performance of the bank by region, branch, and location wise any other parameters.

Automation of Workflow

G Bank-CRM has induced Automated alerts and workflows in the system which helps the Bankers reduce the risk of human errors, and ensure timely completion of the task. For example, when a customer comes to a bank, through the onboarding process the customer can fill in all the details in a few seconds. This helps the Bankers to increase their productivity and efficiency of the organization

Third-Party Integration

G Bank-CRM can easily be integrated with Third Party Applications.

Want to know more about G Bank-CRM?

G Bank-CRM Architecture

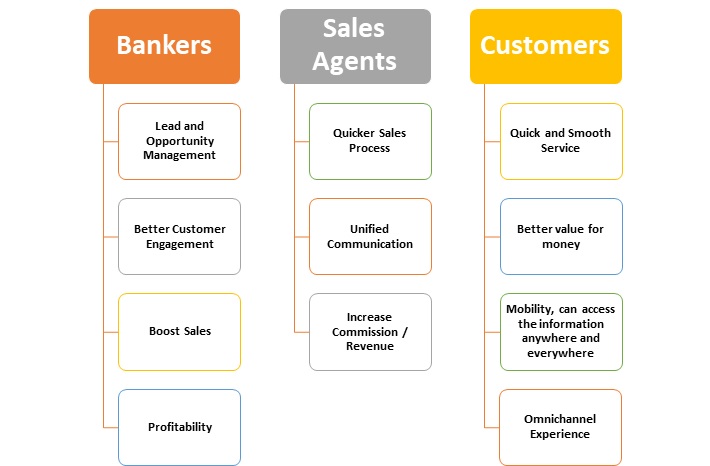

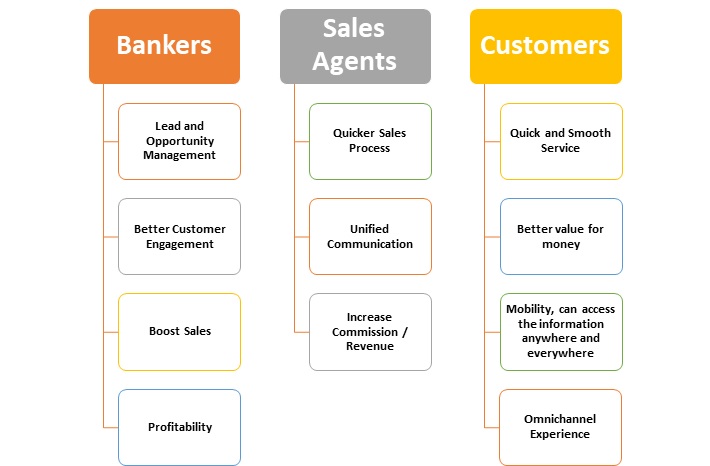

What are the Benefits?