Redefine your customer acquisition

It is imperative, customer engagement plays a vital role in the Banking Industry. Due to stiff competition and technological advancement, Banks are more customer-friendly and innovative in their approach. Traditionally, the customer goes to a bank to open an account and it involves a humungous task of documentation and adhere to various formalities and different departments to open an account. The customer gets riddled with a lot of processes which results in dissatisfaction with the bank. But now it is dramatically changed. Bankers have started to gear up all robustly adopt digital applications where the customer can open an account within a few seconds through omnichannel experience and also ensure that customer gets 100% satisfaction. Bankers ensure that digital onboarding is the best innovation for acquiring more new customers in no time and be more competitive in the market.

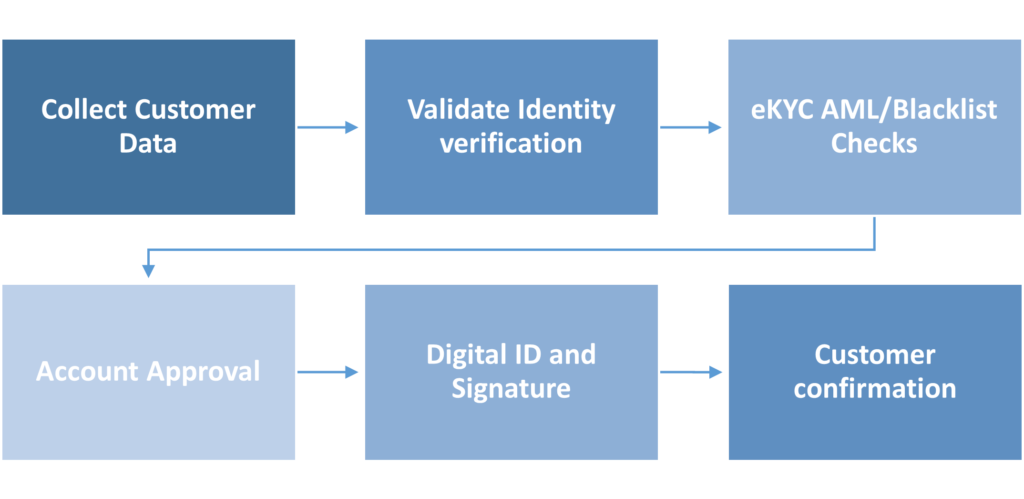

G Digital Onboarding solution is an apt solution for your customer’s end-to-end digital onboarding journey. The customer will go through a simple and seamless process digitally to open an account by completing 6 crucial steps in less than 5 minutes when and wherever required. G Digital Onboarding can be tightly integrated with any core banking application and ensure that Bankers can give a superior customer experience for their customers. Also, it helps the Banks to earn loyalty, increase conversion rates, and lower operational costs.

It is imperative, customer engagement plays a vital role in the Banking Industry. Due to stiff competition and technological advancement, Banks are more customer-friendly and innovative in their approach. Traditionally, the customer goes to a bank to open an account and it involves a humungous task of documentation and adhere to various formalities and different departments to open an account. The customer gets riddled with a lot of processes which results in dissatisfaction with the bank. But now it is dramatically changed. Bankers have started to gear up all robustly adopt digital applications where the customer can open an account within a few seconds through omnichannel experience and also ensure that customer gets 100% satisfaction. Bankers ensure that digital onboarding is the best innovation for acquiring more new customers in no time and be more competitive in the market.

G Digital Onboarding solution is an apt solution for your customer’s end-to-end digital onboarding journey. The customer will go through a simple and seamless process digitally to open an account by completing 6 crucial steps in less than 5 minutes when and wherever required. G Digital Onboarding can be tightly integrated with any core banking application and ensure that Bankers can give a superior customer experience for their customers. Also, it helps the Banks to earn loyalty, increase conversion rates, and lower operational costs.

What are the benefits?

- Instantaneous

- Improved customer experience

- Faster and more flexible access to banking services

- Onboarding in a matter of minutes

- Enhanced digital experience

- Reduce paper usage

- Improved operational effectiveness and efficiency

- Increased customer acquisition

- Reduce fraud

- Customer can open an account anywhere and everywhere

- Adhere to all the rules and regulation of the Bank

6 Steps to frictionless Digital Onboarding journey in banking in less than 5 minutes

Why G Digital Onboarding?

Collect Customer Data

G Digital Onboarding solution will ably capture the relevant customer data using the Mobile Banking or Internet Banking. Customer can use their mobile phone or computer webcam to take pictures of their documents or attach the scanned copies digitally. Data entry, Duplication of data, and Manual errors are completely removed with the help of this technology. Also, the customer gets satisfied with instant results.

Validate Identity Verification

G Digital Onboarding solution can validate customer’s identity verification by using biometric such as fingerprints, facial or voice recognition has become more common and provides authentic data. Once the customer uploads the identity cards the important information is captured, verified, and gives instant notification to customers.

eKYC AML/Blacklist Checks

G Digital Onboarding solution can collect KYC details and electronically verifying the same by de-dupe checks parallelly and fetch details from the anti-money laundering (AML) applications to check the blacklist data globally. This feature helps the bankers to comply with their banking regulations.

Account Approval

G Digital Onboarding solution will verify and validate the KYC details, identification details, and other supporting documents that are uploaded by the customer digitally and instantaneously approve the account.

The customer gets account details within a few minutes.

Digital ID and Signature

G Digital Onboarding solution will capture the customer’s digital signature to authenticate, verify, and approve. G Digital Onboarding solution gets integrated with e-signature application to get the customer consensus and eliminating physical signatures and manual errors. This helps bankers to reduce processing time drastically.

Customer Confirmation

G Digital Onboarding solution helps to create a bank account digitally within a few minutes and a confirmation notification will be sent to the customer via SMS or email to the registered customer’s email address. This gives the customer total satisfaction that his account has been created in no time and has been confirmed with the account details.