Integration is sacrosanct in today’s Banking Operations

Banks play a crucial role in the Nation’s growing economy. To sustain itself in the market, every bank must break the conventional practice and shift it to digital transformation which will augment its efficiency in the industry. It will allow them to create a cohesive and personal journey for each customer in the Banking Industry.

The Core Banking application used by Bankers will give only real-time data of core Banking processes like loans, deposits, credit processing, and other banking activities. But Bankers need an ERP application that helps to integrate and synchronize different organizational systems such as Finance, Procurement, Human Resources, Operations, and other functions from the Back-Office activities. Now here comes an integrator who acts as a catalyst between these two. The only integrator can understand the pivotal touchpoints of the Banking operations and its functionalities.

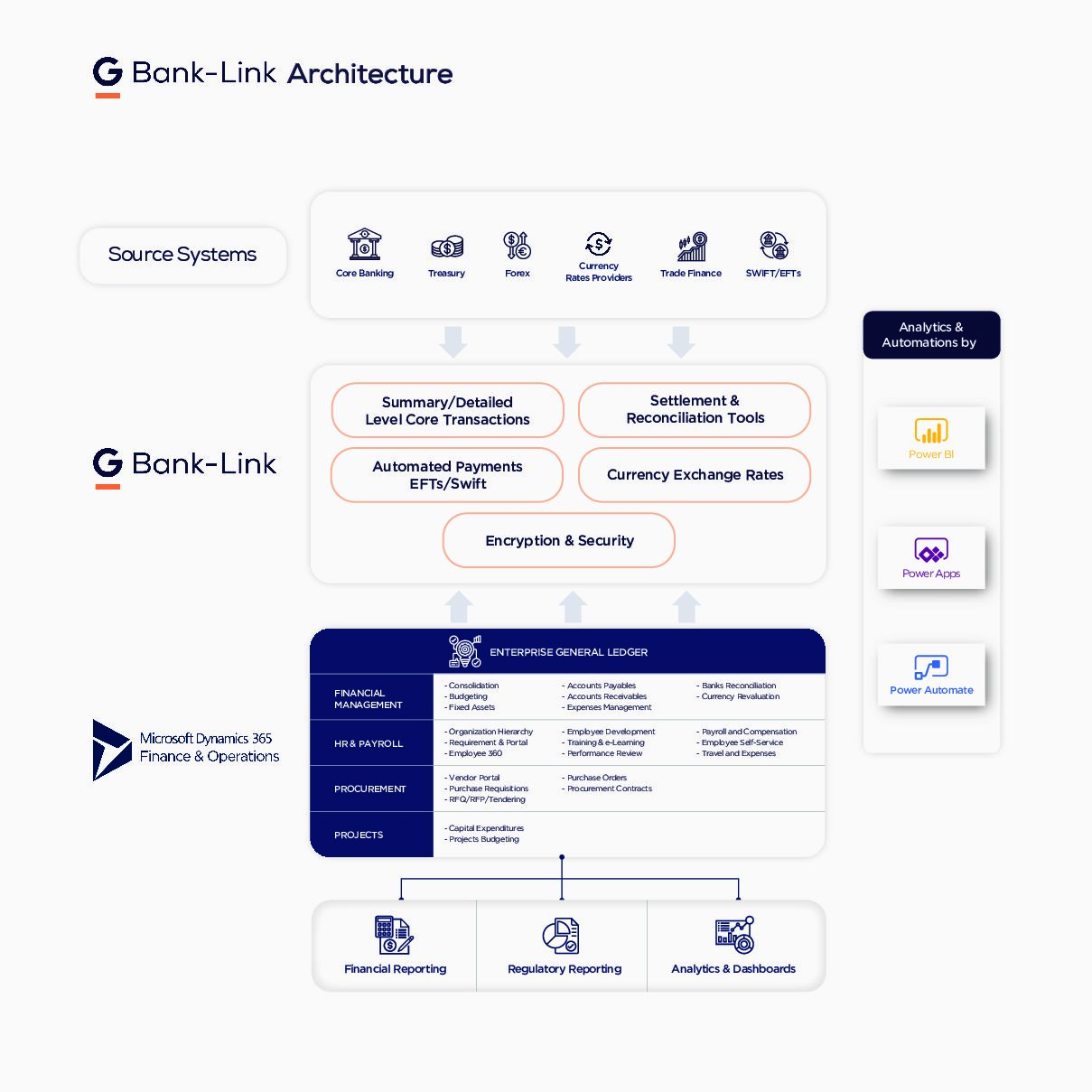

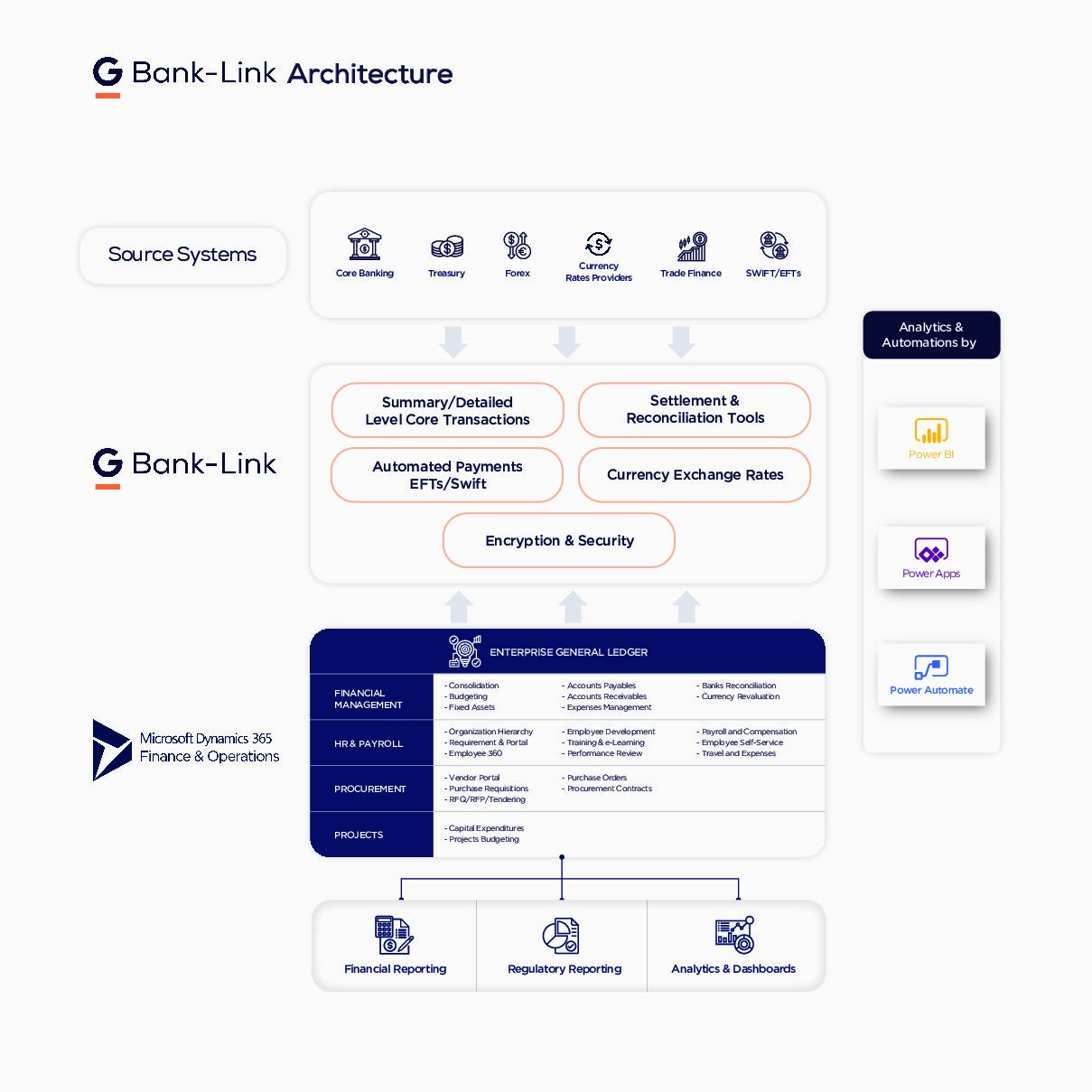

G Bank-Link acts as a seamless integrator and ensures both the Bankers and its customers can avail full benefits of the Core Banking System and Microsoft Dynamics 365 Finance and Operation ERP systems.

G Bank-Link makes sure that data can flow easily between the two without any disruption. It helps the Bankers leave no room for errors and effectively increases the efficiency of the organization.

Banks play a crucial role in the Nation’s growing economy. To sustain itself in the market, every bank must break the conventional practice and shift it to digital transformation which will augment its efficiency in the industry. It will allow them to create a cohesive and personal journey for each customer in the Banking Industry.

The Core Banking application used by Bankers will give only real-time data of core Banking processes like loans, deposits, credit processing, and other banking activities. But Bankers need an ERP application that helps to integrate and synchronize different organizational systems such as Finance, Procurement, Human Resources, Operations, and other functions from the Back-Office activities. Now here comes an integrator who acts as a catalyst between these two. The only integrator can understand the pivotal touchpoints of the Banking operations and its functionalities.

G Bank-Link acts as a seamless integrator and ensures both the Bankers and its customers can avail full benefits of the Core Banking System and Microsoft Dynamics 365 Finance and Operation ERP systems.

G Bank-Link makes sure that data can flow easily between the two without any disruption. It helps the Bankers leave no room for errors and effectively increases the efficiency of the organization.

What do we offer?

- Accounting

- Line of Business

- Regulatory Reports

- Reconciliation Tool

- Payment Planning

- Single source of Accounting

- Exchange Rates

- Multi mode of Payment

- Analytics Reports

- Automation of Workflow

- Third Party Integration

A core banking application mainly works on core operations of the Bank, but it was unable to integrate and gather all data and information from the back-office system. Our Bank was struggling to collate the data and there was a huge gap in communication, a decline in productivity and efficiency. So we were looking for a strong integrator application that can understand the nuances of Banking operation as well as the ERP process.

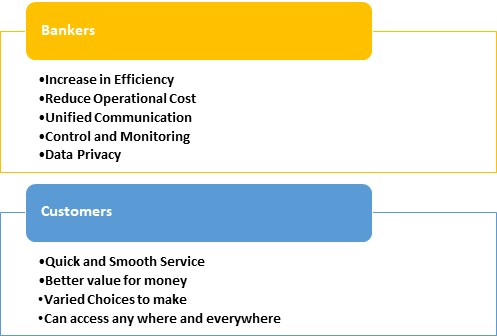

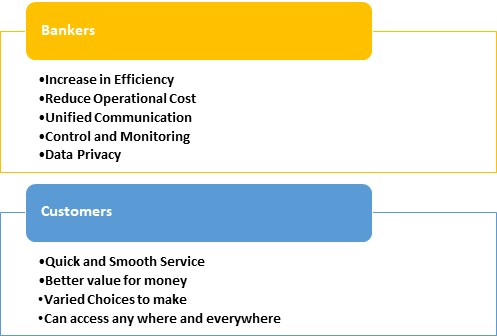

What are the benefits of G Bank-Link?

Why G Bank-Link?

Accounting

G Bank-Link will talk to the core banking system and collate data and merge Microsoft Dynamics 365 Finance & Operations GL module and give banking-related financial reports to the banker such as Financial statements with product-wise profitability, region-wise performance, non-performing assets, Loan to Value, wealth & investment Portfolio Report, credit card performance, etc.

Line of Business

G Bank-Link understands the performance of each line of business. For Banks there are plenty of verticals like retail, corporate, credit card, mortgages, investments and wealth, Deposit and advances, etc., These are again focused on the individual, corporate, High net worth individuals (HNI), professionals, and Govt entities, etc.

Regulatory Reports

Banks must comply with the central / reserve bank (Apex Body) statutory rules and regulations. It is always a challenge for the core banking system (CBS), which is not designed to produce the regulatory reports which are stipulated by the apex body. Hence G Bank-Link helps Banks by pulling relevant data from CBS to comply and submit periodic statutory reports.

Reconciliation Tool

G Bank-Link integrates with the core banking system to bring in accuracy, visibility, clarity, and validation of entries in the financial statements. This will avoid duplication of entries, any mismatches, the commission of entries, etc.

Payment Planning

G Bank-Link which is tightly integrated with the core banking system helps the bank to make payments to vendors, disburse salaries to their staff by scheduling payment at any stipulated timing as per their operational requirements, it will communicate well in advance before the payment hits the account. Thereby the Bank ensures a smooth flow of transactions and keeps its operation efficiency at its best.

Single source of accounting

G Bank-Link which is well integrated with the core banking system makes all types of accounting and financial transactions happen at a centralized system. Hence, it provides complete transparency, clarity, and comprehensive details of the transactions including date, time, source, beneficiary, accounting details, etc.

Exchange Rates

This is required mainly for international remittances, traveler’s cheques, Forex transactions are done by their customers, etc. G Bank-Link is capable of processing multi-currency and integrates with exchange rate providers for the exact values.

Multimode of Payment

Banks are offering different types of services to their customers. Today’s trend in Banking is all about digital transformation. G Bank-Link can facilitate customers to pay/deposit their funds in various forms. E.g. Equated Monthly Installment (EMI) Payment for the loan can be made through online banking, Third-party payment sites using payment gateways, use of debit/credit cards, payment through ATM / CDM machines/kiosk in the branch, cheque payment, mobile banking, etc.

Analytics Report

G Bank-Link with help of Microsoft Power BI, can drill down in detail and produce On-demand dashboards and reports on all the banking activities in the real-time scenario. E.g. with the help of G Bank-Link, Bank can provide dashboard reports to management such as “Demand Vs Collections”, “Branch wise performance”, “Amount of Loan disbursement” and Nonperforming assets (NPA) report. Thus, decision-makers can see the performance of their bank or a branch in particular.

Automation of Workflow

G Bank-Link understands the Banking process and automates most of the workflows of the back-office activities which can easily be integrated with any core banking software. This helps the Bankers to bring speed and efficiency in the operations

Third-Party Integration

G Bank-Link can easily be integrated with Third Party Applications like payment gateways, credit rating agencies, market data for stock/currency rates, etc.

G Bank-Link Architecture

What are the Benefits?